Introduction

Disability insurance is a critical component of an individual’s financial safety net, particularly for those relying on job-based coverage. Yet, many employees are unaware of key limitations in their workplace plans or the potential risks to their financial futures if those gaps go unaddressed. Fully understanding how employer-sponsored disability insurance operates can help professionals and workers proactively safeguard their earnings. For those needing to contest or fully understand such policies, obtaining guidance from an ERISA attorney can be invaluable.

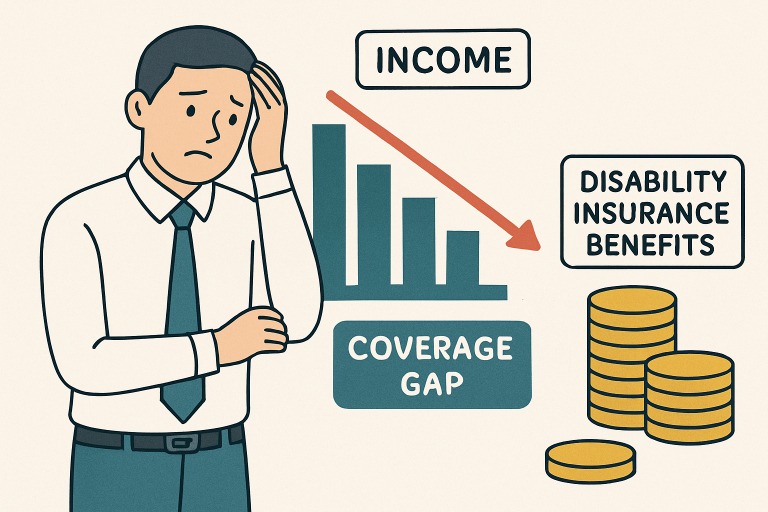

Job-based disability policies are not always as comprehensive as employees might expect. While these benefits can offer a first line of protection, their structure and limits can leave high earners or those with specialized income exposed to substantial financial risks. Gaps in coverage can contribute to economic instability during periods of disability, making it essential to analyze and, if necessary, supplement existing policies to address these gaps.

- Employer-provided disability insurance often has coverage or cap limitations, particularly for higher-wage earners.

- Short-term disability insurance is commonly insufficient for professionals with unique income requirements.

- Supplemental individual disability insurance (IDI) can help bridge the gap for optimum coverage.

- Without adequate disability insurance, the long-term financial impact of a serious illness or injury can be severe.

Understanding Employer-Provided Disability Insurance

Most corporate employers in the U.S. offer some form of disability insurance as part of their employee benefits package. These group policies usually replace around 60% of an employee’s pre-disability income up to a set monthly maximum, often between $5,000 and $10,000. For individuals earning above this threshold, such as physicians, executives, or other high-income professionals, this coverage may fall well short of their actual financial needs during an extended absence from work. For example, an employee earning $200,000 annually could face a steep drop in monthly income if their disability coverage maxes out at $10,000 per month, potentially resulting in a shortfall of thousands of dollars. As noted by Charles Schwab, this is particularly problematic for individuals with ongoing financial obligations, such as mortgages, student loans, or dependent care costs.

The Limitations of Short-Term Disability Policies

Short-term disability insurance, which employers frequently provide as part of their employee benefits package, typically covers absences from work due to illness or injury for periods up to six months. While these policies are useful for managing minor health events, sudden illnesses, or recoveries following surgeries, they generally offer only temporary support during the initial phases of an injury or disease. Professionals with highly specialized and often high-income careers, such as doctors, attorneys, and other specialized practitioners, may quickly find these benefits inadequate for maintaining their standard of living or covering their overhead costs if a disability extends beyond the initial few months. Furthermore, while federal policy initiatives and some legislative efforts sometimes incentivize employers to offer short-term disability coverage to their employees, this coverage often lacks flexibility and customization options for higher-wage earners or those with unique employment circumstances. As a result, when an illness or injury persists for more than a few months, these policies may leave individuals without meaningful or sufficient support at a critical and vulnerable time, potentially jeopardizing their financial stability and professional livelihood.

The Role of Supplemental Individual Disability Insurance

Supplemental Individual Disability Insurance (IDI) presents a significant opportunity to enhance your financial protection and security significantly. Unlike general group plans, IDI policies can be highly customized to fit the specific needs of the policyholder, including setting adequate benefit amounts and tailoring coverage features to match individual circumstances. One of the most valuable advantages of IDI is its portability; these plans remain with you and are accessible even if you change employers, thereby providing continuous peace of mind and financial stability throughout your career. For employees with substantial financial responsibilities, such as supporting a family, paying a mortgage, or saving for future goals, adding an IDI policy can help fill critical gaps in group coverage and ensure income replacement in the event of disability. Those who choose to combine their employer-sponsored policies with a supplemental IDI position themselves in a much better position to maintain stable, long-term financial health and peace of mind in the face of unforeseen health challenges or disabilities.

Financial Implications of Long-Term Disabilities

The financial fallout from long-term disability can be life-altering. Studies show that individuals facing prolonged income loss due to health issues are at greater risk for bankruptcy, foreclosure, and depletion of retirement savings. The lack of sufficient disability income forces many to tap into emergency savings, sell assets, or drastically cut necessary expenses, moves that reverberate well into the future.

Robust disability insurance is the most effective way to counteract this risk. Without it, even those who are otherwise financially stable may find themselves vulnerable, and the process of rebuilding after a financial crisis caused by disability can take years.

Evaluating Your Disability Coverage

Proactive evaluation of current disability coverage is essential. Here’s how to assess your protection level and ensure your long-term security:

- Examine your employer’s policy to identify what percentage of your current income it will replace and review any monthly caps on payouts.

- Estimate how much your take-home pay would shrink if you became disabled, factoring in taxes on benefits if your employer pays the premiums.

- Research supplemental IDI policies to close any gaps, focusing on securing enough coverage to meet your expenses and maintain your standard of living.

- Speak to a financial advisor with experience in disability planning to ensure your insurance portfolio matches your career goals and obligations.

Conclusion

Job-based disability insurance is an essential and foundational component of your overall financial planning strategy, as it provides crucial protection for your earnings and long-term financial security. However, while these plans are valuable, they often serve as only a partial solution, especially for high-income earners and specialized professionals whose income and job roles may expose them to unique risks. To ensure comprehensive protection, it is essential to thoroughly understand the specific policy limits, recognize potential coverage gaps, and utilize supplemental insurance options or riders that can fill these existing gaps. By taking proactive steps to review, customize, and enhance your disability insurance coverage today, you can better safeguard your livelihood, maintain financial stability, and secure your future against the unpredictable uncertainties of life. Being diligent in this process ensures that you are not leaving your financial well-being to chance, but instead creating a robust safety net for yourself and your loved ones.